Now Reading: How to Find the Best Tax-Free Investment Accounts in 2024

- 01

How to Find the Best Tax-Free Investment Accounts in 2024

How to Find the Best Tax-Free Investment Accounts in 2024

Introduction

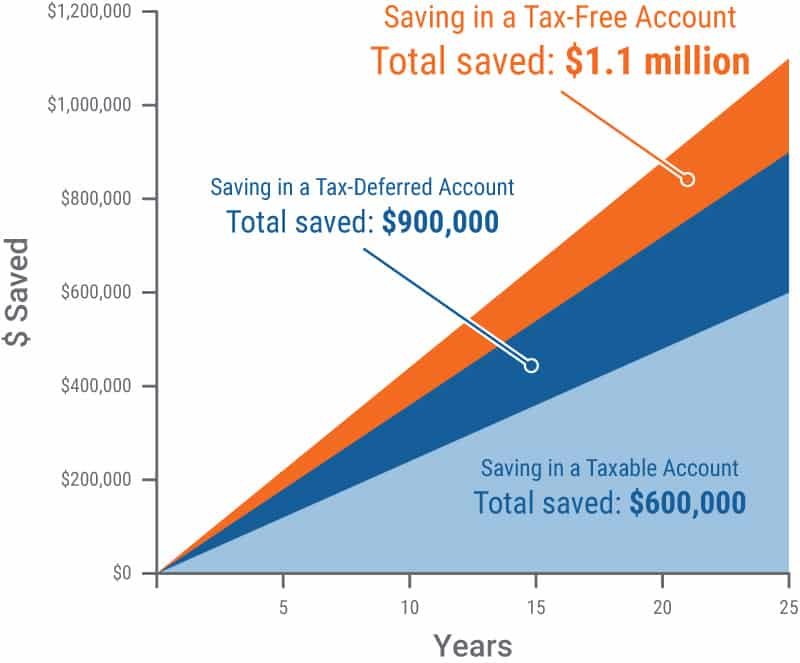

Investing in tax-free accounts is one of the best ways to grow your wealth while keeping more of your money. These accounts allow you to earn interest, dividends, and capital gains without paying taxes, making them essential for smart investors.

In this guide, we will explore the best tax-free investment accounts in 2024, their benefits, and how to choose the right one for your financial goals.

What Are Tax-Free Investment Accounts?

A tax-free investment account (TFIA) allows you to invest money and earn returns without paying taxes on those earnings. This can include capital gains, dividends, or interest.

🔹 Key Benefits of Tax-Free Investment Accounts

✔ No taxes on investment growth ✔ Ideal for long-term wealth building ✔ Can be used for retirement, education, or general savings ✔ Government-backed and legally structured for tax efficiency

Best Tax-Free Investment Accounts in 2024

Here are some of the best options available this year:

1️⃣ Roth IRA (Individual Retirement Account)

✔ Who Can Use It: U.S. investors saving for retirement

✔ Tax Benefit: Withdrawals are tax-free after age 59½

✔ Best For: Long-term retirement savings

✔ Contribution Limit: $7,000 per year ($8,000 if 50+)

✔ Where to Open: Vanguard, Fidelity, Charles Schwab

2️⃣ 401(k) with Roth Option

✔ Who Can Use It: Employees with access to an employer-sponsored plan

✔ Tax Benefit: Contributions grow tax-free, and withdrawals are tax-free in retirement

✔ Best For: Employees maximizing employer matching contributions

✔ Contribution Limit: $23,000 per year ($30,500 if 50+)

✔ Where to Open: Through your employer’s plan provider

3️⃣ Health Savings Account (HSA)

✔ Who Can Use It: Individuals with a high-deductible health plan (HDHP)

✔ Tax Benefit: Contributions, growth, and withdrawals (for medical expenses) are tax-free

✔ Best For: Those looking for a tax-free way to save for medical expenses

✔ Contribution Limit: $4,150 for individuals, $8,300 for families

✔ Where to Open: Lively, Fidelity, HSA Bank

4️⃣ Tax-Free Savings Account (TFSA) (Canada)

✔ Who Can Use It: Canadian investors

✔ Tax Benefit: No taxes on earnings or withdrawals

✔ Best For: General tax-free investing

✔ Contribution Limit: CAD $7,000 per year

✔ Where to Open: RBC, TD Bank, Wealthsimple

How to Choose the Best Tax-Free Investment Account

✅ Step 1: Consider Your Financial Goals

- Are you saving for retirement, healthcare, or general wealth growth?

- Choose an account that aligns with your future needs.

✅ Step 2: Compare Contribution Limits

- Some accounts (e.g., 401(k)) allow higher contributions than others.

- Make sure you maximize contributions for better growth.

✅ Step 3: Check Withdrawal Rules

- Roth IRA and TFSA allow flexible withdrawals.

- HSA funds are tax-free only for medical expenses.

✅ Step 4: Pick a Trusted Investment Platform

- Use trusted brokers like Vanguard, Fidelity, Charles Schwab.

- Look for platforms with low fees and good investment options.

Best Strategies for Growing Wealth with Tax-Free Accounts

✔ Start Investing Early: The longer your money stays invested, the more it grows.

✔ Diversify Your Investments: Use a mix of stocks, bonds, and ETFs.

✔ Maximize Contributions: Always invest up to the limit to get the most benefits.

✔ Reinvest Your Earnings: Let your dividends and interest compound over time.

Frequently Asked Questions (FAQs)

1. Can I have multiple tax-free accounts?

Yes! Many investors use a Roth IRA + 401(k) + HSA to maximize benefits.

2. What happens if I withdraw early?

Some accounts (like Roth IRAs) allow tax-free withdrawals of contributions. Others (like 401(k)s) have penalties for early withdrawal.

3. Are tax-free accounts better than taxable investment accounts?

Yes, for long-term savings. But if you need flexibility, a brokerage account may be better.

Final Thoughts

A tax-free investment account is one of the best ways to grow your wealth while keeping more of your money. Whether you’re saving for retirement, healthcare, or general investing, choosing the right account can help you build financial security tax-free.

Start investing today and let your money grow without tax burdens! 🚀