Now Reading: Best Mortgage Refinance Rates in 2024: How to Get the Best Deal

- 01

Best Mortgage Refinance Rates in 2024: How to Get the Best Deal

Best Mortgage Refinance Rates in 2024: How to Get the Best Deal

Introduction

Refinancing your mortgage in 2024 could save you thousands of dollars in interest and lower your monthly payments. But with so many options available, how do you choose the best deal?

In this guide, we’ll walk you through how mortgage refinancing works, current interest rate trends, and tips to secure the lowest refinance rate.

What is Mortgage Refinancing?

Mortgage refinancing means replacing your current home loan with a new one—usually with a lower interest rate, better terms, or cash-out options.

✅ Why Refinance?

✔ Lower your monthly mortgage payments

✔ Reduce your loan term (e.g., from 30 years to 15 years)

✔ Cash out home equity for renovations or debt consolidation

✔ Switch from an adjustable-rate mortgage (ARM) to a fixed-rate loan

Current Mortgage Refinance Rates in 2024

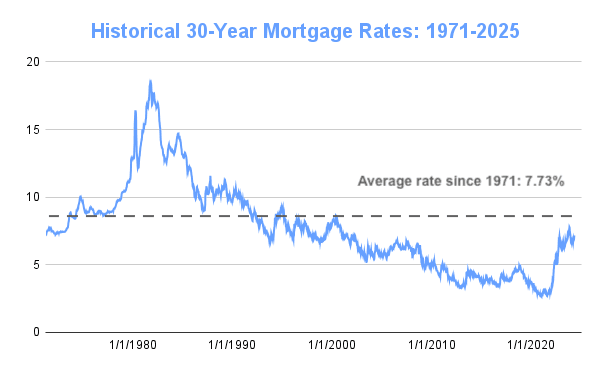

Refinance rates are influenced by the Federal Reserve, inflation, and the economy. Here are the latest average refinance rates:

| Loan Type | Current Rate (2024) | Best for |

|---|---|---|

| 30-Year Fixed | 6.75% | Lower monthly payments |

| 15-Year Fixed | 5.90% | Faster payoff, less interest |

| 5/1 ARM | 6.25% | Short-term savings before adjusting |

| Cash-Out Refinance | 7.00% | Accessing home equity |

🔹 Pro Tip: Rates can change daily, so lock in a rate when you find a great deal.

How to Get the Best Mortgage Refinance Rates

✅ Step 1: Improve Your Credit Score

✔ Pay down existing debts

✔ Make all payments on time

✔ Keep your credit utilization low

✔ Check your credit report for errors

✅ Step 2: Shop Around for Lenders

✔ Compare rates from multiple lenders (banks, credit unions, online lenders)

✔ Ask about lender fees and closing costs

✔ Use online mortgage marketplaces for the best rates

✅ Step 3: Consider Different Loan Terms

✔ A 15-year mortgage has lower interest but higher monthly payments

✔ A 30-year mortgage offers lower payments but more total interest

✔ Adjustable-rate mortgages (ARMs) can start lower but may increase later

✅ Step 4: Lock in Your Rate at the Right Time

✔ Keep an eye on Federal Reserve rate decisions

✔ Lock in your rate before rates increase

✔ Consider working with a mortgage broker for better deals

Cash-Out Refinancing: Is It Right for You?

A cash-out refinance lets you borrow against your home’s equity for expenses like home improvements or debt consolidation.

✅ Pros:

✔ Access extra cash for home projects or debt payoffs

✔ Possibly lower interest than personal loans

✔ May improve your overall financial position

❌ Cons:

✖ Higher loan balance = more debt

✖ Potentially higher monthly payments

✖ Risk of foreclosure if unable to pay

🔹 Pro Tip: Only use cash-out refinancing for high-value investments like home upgrades, not unnecessary spending.

Frequently Asked Questions (FAQs)

1. When should I refinance my mortgage?

Refinancing makes sense when:

✔ Rates are at least 0.50%-1% lower than your current rate

✔ You plan to stay in your home long enough to recover closing costs

✔ You want to pay off your mortgage faster with a shorter loan term

2. How much does refinancing cost?

Typical closing costs range from 2-5% of the loan amount. Always check for fees like:

✔ Origination fees

✔ Appraisal fees

✔ Title insurance

✔ Prepayment penalties (if applicable)

3. Does refinancing hurt my credit score?

✔ A small temporary dip may occur due to a hard inquiry

✔ Your score can improve over time if you lower debt and make timely payments

Final Thoughts

Refinancing your mortgage in 2024 can lower your payments, reduce your loan term, or give you access to cash. By shopping around and improving your financial profile, you can get the best possible refinance rate.

📌 Best Next Steps:

1️⃣ Compare rates from multiple lenders

2️⃣ Improve your credit score for better offers

3️⃣ Decide whether a lower rate, shorter term, or cash-out option is best for you

🚀 Start saving on your mortgage today!