Now Reading: How to Master Your Finances in 2025: Expert Tips & Guides

- 01

How to Master Your Finances in 2025: Expert Tips & Guides

How to Master Your Finances in 2025: Expert Tips & Guides

🌟 Introduction

Managing your finances in 2025 requires more than just saving money. With evolving technology, inflation concerns, and new investment opportunities, it’s crucial to stay ahead. This guide will provide expert tips to help you achieve financial success this year.

🔑 1. Set Clear Financial Goals

Start by defining your short-term and long-term goals. Whether it’s buying a house, saving for retirement, or building an emergency fund, having clear goals keeps you focused.

How to Set Financial Goals:

- Identify your priorities (e.g., home, travel, education).

- Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound).

- Use budgeting apps like YNAB or Mint to track progress.

👉 Example: If you want to save $10,000 by the end of 2025, break it down into monthly or weekly savings targets.

📊 2. Build a Smart Budget

Budgeting is the foundation of financial success. It helps you track your income, expenses, and savings.

Steps to Build a Budget:

- Calculate your monthly income.

- List all fixed and variable expenses.

- Allocate 50% for needs, 30% for wants, and 20% for savings (50/30/20 rule).

- Review and adjust monthly.

💡 Pro Tip: Use tools like Google Sheets or budgeting apps to simplify the process.

💰 3. Save and Invest Wisely

Savings alone won’t build wealth. Investing helps your money grow over time.

Best Investment Options for 2025:

- High-Interest Savings Accounts: Look for accounts with at least 4-5% APY.

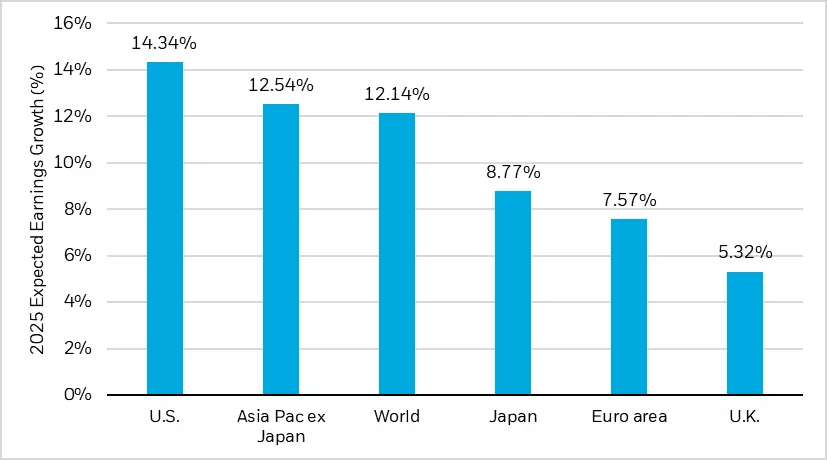

- Index Funds & ETFs: Diversify your portfolio with low-cost index funds.

- Cryptocurrency: Consider Bitcoin or Ethereum but allocate only a small portion.

- Real Estate: If possible, invest in rental properties or REITs.

💡 Pro Tip: Automate your investments through platforms like M1 Finance or Acorns.

📈 4. Boost Your Income Streams

Relying on a single income stream can be risky. Explore side hustles or passive income opportunities.

Top Side Hustles in 2025:

- Freelancing: Writing, graphic design, and web development.

- Online Courses: Create and sell courses on platforms like Udemy.

- Affiliate Marketing: Promote products and earn commissions.

- Rental Income: Airbnb or long-term property rentals.

💡 Pro Tip: Choose side hustles that align with your skills and passions.

🛡️ 5. Protect Your Finances

Insurance and emergency funds are crucial for financial security.

Must-Have Protections:

- Emergency Fund: Save 3–6 months’ worth of expenses.

- Health Insurance: Ensure coverage for unexpected medical costs.

- Life Insurance: Essential if you have dependents.

- Identity Theft Protection: Use tools like LifeLock.

💡 Pro Tip: Keep your emergency fund in a high-yield savings account.

📚 6. Stay Educated and Informed

Financial trends change quickly. Keep learning through books, blogs, and podcasts.

Recommended Resources:

- Books: “The Psychology of Money” by Morgan Housel.

- Podcasts: The Dave Ramsey Show, ChooseFI.

- Blogs: SmartBudgetHub.com (of course!).

💡 Pro Tip: Set aside 10 minutes daily to read financial news.

🌟 Final Thoughts: Take Control of Your Finances Today

Mastering your finances in 2025 requires planning, discipline, and continuous learning. By setting clear goals, budgeting smartly, investing wisely, and protecting your assets, you’ll be on the path to financial freedom.

👉 What’s your top financial goal for 2025? Share your thoughts in the comments below!