Now Reading: 💰 How to Build a Sustainable Emergency Fund

- 01

💰 How to Build a Sustainable Emergency Fund

💰 How to Build a Sustainable Emergency Fund

🌟 Introduction

Life is full of unexpected surprises—car repairs, medical bills, or sudden job loss. An emergency fund is your financial safety net, protecting you from debt and stress when life throws curveballs.

This guide will show you how to build a sustainable emergency fund step by step, no matter your income level.

1. Understand Why an Emergency Fund Matters

Having an emergency fund helps you:

- 🛡️ Avoid debt when unexpected expenses arise.

- 🕰️ Buy time if you lose your job or face income gaps.

- 😌 Enjoy peace of mind, knowing you’re financially secure.

💡 Tip: Experts recommend saving 3 to 6 months’ worth of expenses for emergencies.

2. Set Your Emergency Savings Goal

How much do you need in your emergency fund?

🎯 How to Calculate:

- List Monthly Expenses: Rent, utilities, groceries, transportation, insurance.

- Multiply by 3 to 6: If your monthly expenses are $2,500, aim to save $7,500 to $15,000.

- Start Small: If the goal feels overwhelming, start with $500 to $1,000 as an initial cushion.

💡 Tip: Break your goal into milestones: $500 → $1,000 → $3,000 → $10,000.

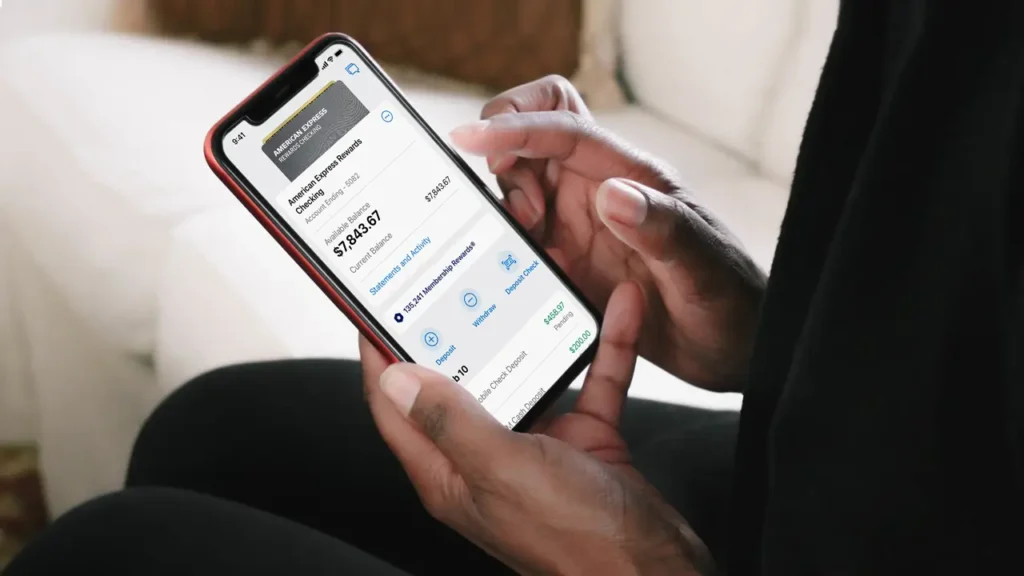

3. Choose the Right Place to Save

Your emergency fund should be easily accessible but separate from everyday spending.

🏦 Best Places to Keep Your Fund:

- High-Yield Savings Account: Earn interest while keeping money safe.

- Money Market Account: Offers higher interest with check-writing privileges.

- Separate Bank Account: Prevents temptation to spend.

💡 Tip: Avoid keeping emergency savings in investment accounts—they’re too risky for short-term needs.

4. Automate Your Savings

Consistency is key. Automating your savings ensures you build your fund without effort.

🔄 How to Automate:

- Direct Deposit: Allocate part of your paycheck to a dedicated savings account.

- Recurring Transfers: Schedule automatic transfers from checking to savings.

- Micro-Savings Apps: Apps like Acorns, Digit, or Qapital round up purchases and save the difference.

💡 Tip: Start with just $20 to $50 per week—it adds up quickly!

5. Cut Expenses to Save Faster

Trimming non-essential expenses frees up more money for your emergency fund.

✂️ Easy Ways to Cut Costs:

- Cancel Unused Subscriptions: Streaming services, apps, memberships.

- Cook at Home: Save $200+ per month by reducing dining out.

- Shop Smarter: Use coupons, cashback apps, and buy in bulk.

💡 Tip: Redirect savings from expense cuts directly into your emergency fund.

6. Boost Savings with Extra Income

Side income accelerates your savings progress.

💼 Ideas to Earn Extra:

- Freelancing: Write, design, or offer virtual services.

- Sell Unused Items: Clothes, gadgets, furniture.

- Gig Work: Drive for Uber, deliver with DoorDash, or walk dogs on Rover.

💡 Tip: Dedicate all side hustle income to your emergency fund until you hit your target.

7. Use Windfalls Wisely

Unexpected money can supercharge your savings.

💸 Best Ways to Save Windfalls:

- Tax Refunds: Direct the entire refund to your fund.

- Bonuses: Allocate at least 50% to savings.

- Gift Money: Birthday, holiday, or cash gifts.

💡 Tip: Treat windfalls as a savings opportunity, not spending money.

8. Know When to Use Your Emergency Fund

Only tap into your emergency fund for true emergencies, such as:

- 🚑 Medical emergencies

- 🚗 Urgent car repairs

- 🏠 Essential home repairs

- 💼 Job loss or sudden income drop

💡 Tip: Replenish your fund immediately after using it.

🌟 Conclusion

Building a sustainable emergency fund takes time and discipline, but it’s worth it. Start small, automate savings, cut unnecessary expenses, and use windfalls wisely.

By following these steps, you’ll create a financial safety net that brings peace of mind and keeps you prepared for life’s surprises.