Now Reading: Life Insurance Quotes 2024: How to Get the Best Rates

- 01

Life Insurance Quotes 2024: How to Get the Best Rates

Life Insurance Quotes 2024: How to Get the Best Rates

Introduction

Life insurance is an essential financial tool that provides security for your loved ones. However, getting the best rates requires understanding how quotes work, what factors affect pricing, and where to find the best policies.

In this guide, we’ll explore the best ways to compare life insurance quotes in 2024, key factors that determine your rate, and how to lock in the lowest premiums.

Why Life Insurance Matters

✔ Protects Your Family’s Future – Provides financial security in case of unexpected loss.

✔ Covers Debts & Expenses – Pays off loans, mortgages, and funeral costs.

✔ Builds Wealth – Some policies include cash value that grows over time.

✔ Peace of Mind – Ensures your loved ones won’t struggle financially.

Types of Life Insurance

There are several types of life insurance policies. Choosing the right one depends on your needs and budget.

1️⃣ Term Life Insurance (Best for Affordability)

✔ Covers a specific period (10, 20, or 30 years).

✔ Lower premiums compared to whole life insurance.

✔ Best for: Young families, mortgage protection, income replacement.

✔ Example Providers: Haven Life, Banner Life, AIG.

2️⃣ Whole Life Insurance (Best for Lifetime Coverage)

✔ Covers you for life (does not expire).

✔ Builds cash value that grows over time.

✔ Best for: Estate planning, leaving an inheritance, wealth building.

✔ Example Providers: MassMutual, Northwestern Mutual, New York Life.

3️⃣ Universal Life Insurance (Best for Flexibility)

✔ Lifetime coverage with adjustable premiums.

✔ Builds cash value that can be used later.

✔ Best for: Those who want investment options along with insurance.

✔ Example Providers: Prudential, Guardian Life.

4️⃣ No-Exam Life Insurance (Best for Quick Approval)

✔ No medical exam required – Faster approval process.

✔ Higher premiums due to increased risk for insurers.

✔ Best for: People with health issues or those who need immediate coverage.

✔ Example Providers: Bestow, Ethos, Fidelity Life.

How to Get the Best Life Insurance Quotes

✅ Step 1: Know How Much Coverage You Need

- Rule of Thumb: Get a policy 10–15 times your annual income.

- Consider debts, future expenses (college, mortgage), and lost income.

✅ Step 2: Compare Multiple Quotes

- Use online comparison tools like Policygenius, NerdWallet, or Insure.com.

- Contact multiple insurance companies directly to compare offers.

✅ Step 3: Improve Your Health Before Applying

- Quit smoking – Tobacco users pay 50–100% more in premiums.

- Maintain a healthy weight – Obesity can increase rates significantly.

- Lower blood pressure & cholesterol – Some companies offer discounts for healthy checkups.

✅ Step 4: Choose the Right Policy Length

- If you only need coverage for your mortgage or kids’ education, a term policy may be best.

- If you want lifetime coverage + investment benefits, choose whole life or universal life insurance.

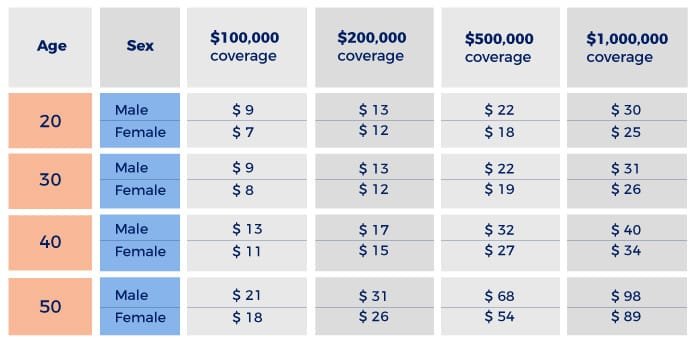

✅ Step 5: Apply at the Right Age

- The younger you apply, the cheaper your rates.

- Example: A 30-year-old non-smoker pays $20/month for a $500,000 term policy, while a 50-year-old pays $80/month.

Best Companies for Life Insurance Quotes in 2024

Here are the top companies offering competitive life insurance rates this year:

| Company | Best For | Estimated Monthly Cost (30-Year-Old, $500K Term) |

|---|---|---|

| Haven Life | Affordable Term Life | $18–$25 |

| Northwestern Mutual | Best Whole Life | $50–$100+ |

| Policygenius | Best Quote Comparison | Varies |

| AIG | No-Exam Life Insurance | $30–$60 |

| Prudential | Universal Life | Varies |

Common Mistakes to Avoid When Buying Life Insurance

❌ Waiting Too Long – The longer you wait, the more expensive your policy will be.

❌ Choosing the Wrong Coverage Amount – Too little coverage won’t protect your family. Too much means overpaying.

❌ Ignoring Riders & Benefits – Add-ons like critical illness coverage can enhance protection.

❌ Skipping the Medical Exam – If you’re healthy, taking a medical exam can lower your rates.

Frequently Asked Questions (FAQs)

1. How long does it take to get a life insurance quote?

- Instant online quotes take 1–2 minutes.

- Full application approval can take a few days to weeks.

2. Can I get life insurance with a pre-existing condition?

Yes, but expect higher premiums. No-exam policies can be an option, but they cost more.

3. What happens if I stop paying my premiums?

Your coverage will lapse, and you will lose your protection. Some policies have a grace period to catch up.

Final Thoughts

Getting the best life insurance quotes in 2024 requires smart planning and comparison shopping. By understanding the types of policies, factors affecting rates, and where to find the best quotes, you can secure an affordable policy that meets your financial needs.

Don’t wait—get a quote today and protect your loved ones! 🚀