Now Reading: Top Robo-Advisors in 2024 Best Automated Investment Platforms for Beginners

- 01

Top Robo-Advisors in 2024 Best Automated Investment Platforms for Beginners

Top Robo-Advisors in 2024 Best Automated Investment Platforms for Beginners

Introduction

Investing has never been easier thanks to robo-advisors—automated platforms that help you grow your wealth with minimal effort. These platforms use AI-driven algorithms to create and manage investment portfolios tailored to your risk tolerance and financial goals.

If you’re a beginner looking to invest but don’t know where to start, this guide will walk you through the best robo-advisors in 2024, their features, and how to choose the right one.

1. What Are Robo-Advisors?

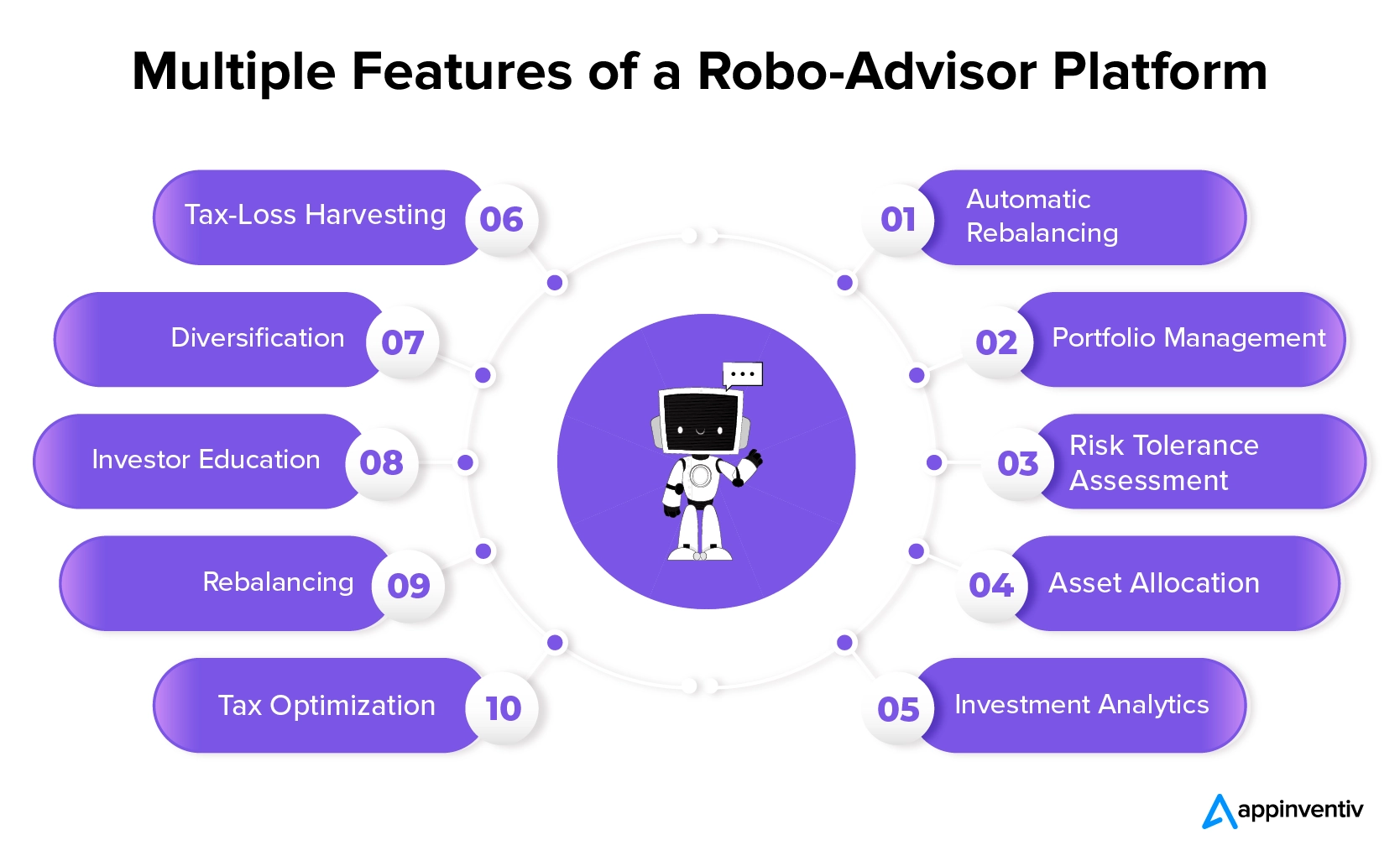

A robo-advisor is an automated financial advisor that creates an investment portfolio based on your answers to a short questionnaire. It then manages your investments by automatically rebalancing your portfolio and reinvesting dividends.

Benefits of Robo-Advisors:

✔ Low Fees – Cheaper than traditional financial advisors.

✔ Hands-Free Investing – No need for active management.

✔ Personalized Portfolio – Matches your risk tolerance and goals.

✔ 24/7 Access – Manage your investments anytime from your phone or computer.

🔹 Pro Tip: Robo-advisors are ideal for long-term investors who want a simple, hassle-free way to invest.

2. Best Robo-Advisors in 2024

Here’s a comparison of the top robo-advisors available this year.

1. Betterment – Best for Beginners

💰 Fees: 0.25% annual management fee

📈 Minimum Investment: $0

✅ Features: Tax-loss harvesting, socially responsible investing, and automatic rebalancing.

2. Wealthfront – Best for Advanced Investors

💰 Fees: 0.25% annual management fee

📈 Minimum Investment: $500

✅ Features: Portfolio line of credit, tax-loss harvesting, and diversified asset options.

3. M1 Finance – Best for Self-Directed Investors

💰 Fees: 0% for basic accounts, M1 Plus ($125/year) for advanced features

📈 Minimum Investment: $100

✅ Features: Allows DIY investing with robo-advisory support.

4. Acorns – Best for Micro-Investing

💰 Fees: $3-$5/month

📈 Minimum Investment: $0

✅ Features: Rounds up spare change from purchases and invests it automatically.

5. SoFi Automated Investing – Best for Free Management

💰 Fees: 0% management fee

📈 Minimum Investment: $1

✅ Features: No advisory fees, goal-based investing, and free financial planning sessions.

📌 Comparison Table of Top Robo-Advisors

| Robo-Advisor | Best For | Fees | Minimum Investment |

|---|---|---|---|

| Betterment | Beginners | 0.25% | $0 |

| Wealthfront | Advanced Investors | 0.25% | $500 |

| M1 Finance | DIY Investors | 0% (basic) | $100 |

| Acorns | Micro-Investing | $3-$5/month | $0 |

| SoFi Automated Investing | Free Investing | 0% | $1 |

3. How to Choose the Right Robo-Advisor

Choosing the best robo-advisor depends on your investment goals and risk tolerance.

Consider These Factors:

✔ Fees & Minimum Investment – Look for low-cost platforms with reasonable deposit requirements.

✔ Investment Strategy – Some focus on ETFs, while others offer stocks, bonds, and even cryptocurrency.

✔ Tax Optimization – If you have taxable accounts, choose a platform with tax-loss harvesting.

✔ Human Support – Some robo-advisors offer access to financial planners for extra guidance.

🔹 Pro Tip: If you’re a beginner, start with a low-fee robo-advisor like Betterment or SoFi.

4. Are Robo-Advisors Safe?

Yes! Robo-advisors are regulated financial services that use encryption and security measures to protect your investments.

✅ Why They’re Safe:

✔ Registered with the Securities and Exchange Commission (SEC).

✔ Funds are insured by the Securities Investor Protection Corporation (SIPC).

✔ Advanced encryption protects personal and financial data.

5. How to Get Started with a Robo-Advisor

Follow these steps to start investing with a robo-advisor today:

1️⃣ Choose a Platform – Compare fees, features, and investment options.

2️⃣ Sign Up & Answer Questions – Complete a short questionnaire to assess your risk tolerance.

3️⃣ Fund Your Account – Deposit money (some platforms require $0 to start).

4️⃣ Start Investing – Your robo-advisor will build a diversified portfolio for you.

5️⃣ Monitor Progress – Check your account occasionally to ensure you’re on track.

🔹 Pro Tip: Start with small contributions and increase them over time as you get comfortable with investing.

Final Thoughts

Robo-advisors are an excellent choice for beginners and busy investors who want an easy, low-cost way to grow their wealth. By choosing the right platform, you can invest smarter and achieve your financial goals without the stress of active trading.

📌 Best Next Steps:

1️⃣ Pick a robo-advisor that suits your needs (low fees, easy to use).

2️⃣ Set up an account and start investing as little as $10 per week.

3️⃣ Monitor your portfolio but avoid panic selling—investing is long-term!

🚀 Start investing today and build wealth effortlessly with a robo-advisor!